Research

June 06, 2025

Total restaurant industry jobs

Restaurants added jobs for the third consecutive month in May

Restaurant employment rose for the third consecutive month in May, which fully restored the jobs that were lost during the first two months of the year.

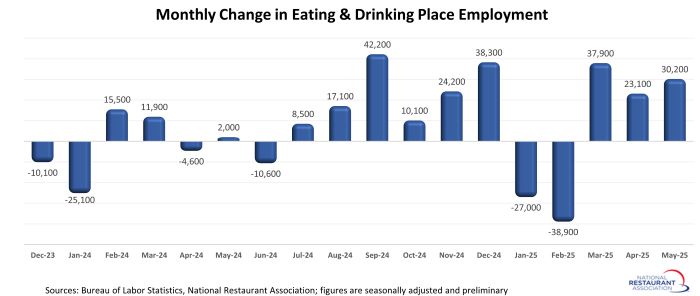

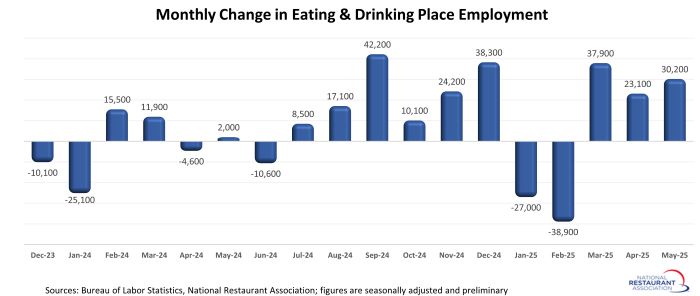

Eating and drinking places* added a net 30,200 jobs in May on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS). That followed combined gains of more than 60,000 jobs in March and April.

The 91,000 jobs added during the last three months represented the strongest 3-month hiring streak since early-2023. It also confirmed that the job losses in January and February were largely due to poor weather conditions – rather than a turning point in the industry’s workforce expansion.

As a result, the National Restaurant Association continues to forecast that the overall restaurant and foodservice industry will add 200,000 jobs during 2025, of which 150,000 will be in the eating and drinking place sector.

The recent rebound in job growth pushed the size of the restaurant workforce to a new record high. As of May 2025, eating and drinking place employment was 105,300 jobs (or 0.9%) above its February 2020 levels.

Fullservice segment remains 237k jobs below pre-pandemic levels

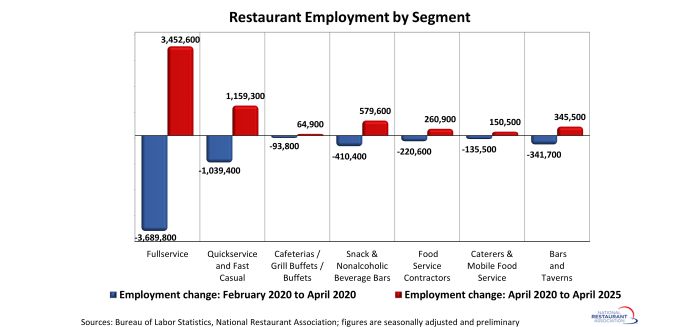

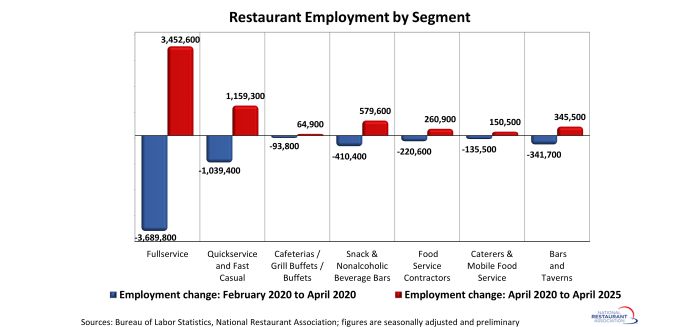

Within the restaurant industry, the limited-service segments continue to set the pace in terms of job growth.

The coffee and snack segment has led the way throughout the recovery from pandemic-induced job losses. As of April 2025, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was 169,000 jobs (or nearly 21%) above February 2020 readings.

Employee counts at quickservice and fast casual restaurants were 120,000 jobs (or 2.6%) above pre-pandemic levels.

In contrast, fullservice restaurant employment levels remained 237,000 jobs (or 4.2%) below pre-pandemic readings, as of April 2025.

[Note that the segment-level employment figures are lagged by one month, so April 2025 is the most current data available.]

Restaurant job growth uneven across states

More than 5 years after the onset of the pandemic in the U.S., restaurant staffing levels remain below pre-pandemic readings in 20 states and the District of Columbia.

This group was led by West Virginia, which had more than 6% fewer eating and drinking place jobs in April 2025 than it did in April 2019. Massachusetts (-6%), Maryland (-5%), Vermont (-4%) and New Mexico (-4%) were also well below their pre-pandemic restaurant employment levels.

In contrast, restaurant employment in several of the mountain states has climbed well beyond pre-pandemic levels. This group is led by Idaho (+16%), Nevada (+14%), Utah (+14%) and Arizona (+11%).

[Note that the state-level analysis uses April 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available for every state.]

View the latest employment data for every state.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of more than 15.7 million.

Track more economic indicators and read more analysis and commentary from the Association's economists.

Eating and drinking places* added a net 30,200 jobs in May on a seasonally-adjusted basis, according to preliminary data from the Bureau of Labor Statistics (BLS). That followed combined gains of more than 60,000 jobs in March and April.

The 91,000 jobs added during the last three months represented the strongest 3-month hiring streak since early-2023. It also confirmed that the job losses in January and February were largely due to poor weather conditions – rather than a turning point in the industry’s workforce expansion.

As a result, the National Restaurant Association continues to forecast that the overall restaurant and foodservice industry will add 200,000 jobs during 2025, of which 150,000 will be in the eating and drinking place sector.

The recent rebound in job growth pushed the size of the restaurant workforce to a new record high. As of May 2025, eating and drinking place employment was 105,300 jobs (or 0.9%) above its February 2020 levels.

Fullservice segment remains 237k jobs below pre-pandemic levels

Within the restaurant industry, the limited-service segments continue to set the pace in terms of job growth.

The coffee and snack segment has led the way throughout the recovery from pandemic-induced job losses. As of April 2025, employment at snack and nonalcoholic beverage bars – including coffee, donut and ice cream shops – was 169,000 jobs (or nearly 21%) above February 2020 readings.

Employee counts at quickservice and fast casual restaurants were 120,000 jobs (or 2.6%) above pre-pandemic levels.

In contrast, fullservice restaurant employment levels remained 237,000 jobs (or 4.2%) below pre-pandemic readings, as of April 2025.

[Note that the segment-level employment figures are lagged by one month, so April 2025 is the most current data available.]

Restaurant job growth uneven across states

More than 5 years after the onset of the pandemic in the U.S., restaurant staffing levels remain below pre-pandemic readings in 20 states and the District of Columbia.

This group was led by West Virginia, which had more than 6% fewer eating and drinking place jobs in April 2025 than it did in April 2019. Massachusetts (-6%), Maryland (-5%), Vermont (-4%) and New Mexico (-4%) were also well below their pre-pandemic restaurant employment levels.

In contrast, restaurant employment in several of the mountain states has climbed well beyond pre-pandemic levels. This group is led by Idaho (+16%), Nevada (+14%), Utah (+14%) and Arizona (+11%).

[Note that the state-level analysis uses April 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available for every state.]

View the latest employment data for every state.

*Eating and drinking places are the primary component of the total restaurant and foodservice industry, providing jobs for roughly 80% of the total restaurant and foodservice workforce of more than 15.7 million.

Track more economic indicators and read more analysis and commentary from the Association's economists.